Digital Banking Branch (Banking iKiosk)

Why Make a Digital Bank Transformation?

The need for digital banks or digital branches is driven by growing customer expectations for digital banking experiences. Customers tend to favor banks that have applied a form of digital transformation, ones that accommodate digital consumer behaviors and self-service. Customers return to banks with shorter turnaround times, 24x7x365 availability and accessibility, and omnichannel interactions.

Banks, on the other hand, want to add features much faster, extend their presence without opening new branches, reduce the number of steps and people involved in transactions, reduce the risk of financial errors, increase their customer base and sales.

IBS Self-Service Branch Solution

At IBS, we believe that the future of banking lies in providing a true omni-channel experience, with the right mix between a physical branch and digital branch.

Bank branches need to transform and adopt a digital technology platform, where banking services are automated and delivered through multiple channels such as self-service banking kiosks, mobile banking applications, and digital banking wallets. Yet, banks still need to focus on customers opting real-time assistance and personalized services.

Our Digital Banking Branch Solution integrates digital technology with traditional banking. The IBS Digital Banking Branch Solution is customized to meet the bank's specific needs and comprises five zones: Quick Banking Zone, Printing Zone, Mobile Banking Zone, Video Conferencing Zone, and Interactive Digital Wall. Each zone addresses specific customer needs and improves the efficiency of delivered operations.

IBS Digital Banking Branch Solution provides bank customers with a reliable and secure platform to:

1. Process real-time electronic banking services (eservices)

2. Connect with their bank on the go as per their schedule

3. Have face-to-face dialogues with bank agents

4. Learn more about the banking services and products

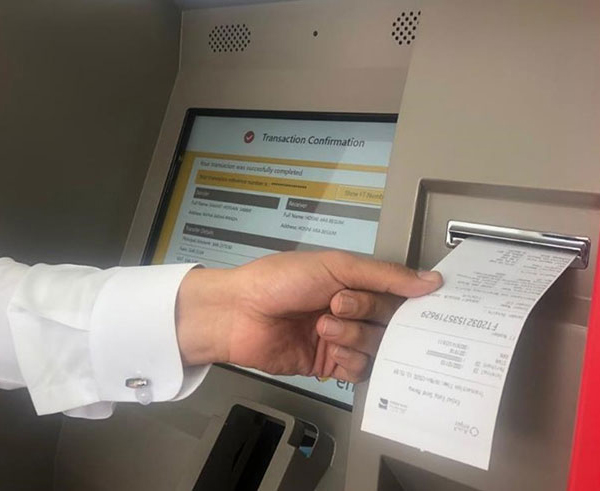

One of the main components in a Digital Branch is the smart Banking Self-Service Machine (SSM). It functions like a normal bank clerk but even faster! The smart IBS Banking ATM executes many transactions such as opening accounts, issuing bank cards, processing KYC, registration, managing loans, paying bills (cash payments or credit payments), deposits/withdrawals, printing documents, and instant money remittances. Moreover, the Banking Mobile App and Mobile Wallet are additional channels that users can utilize for payments, top-ups, requesting loans, issuing bank cards, money transfers, and more!

Benefits

• 24/7 Availability• Secure and Easy to Use

• Enhanced queue management

• Boosted Sales

• Expanded service portfolio

• Reduced operational cost

• Enhanced branding

• Cost-effective

Functions

• Process KYC (face recognition, fingerprint)• Issue Cheque Book

• Withdraw Cash

• Deposit Cash

• Transfer Account

• Print Account Statement

• Print Transaction Proof

• Issue Card (Credit, Debit, Prepaid)

• Contactless Payments (ePayments)

• E-Voucher/E-Top Up

• Early/Late Repayment

• E-Ticketing

• Request Loan, Mortgage, Credit Card

• Scan & Submit Document

• Automated Remittance

• Payment Order

• Video Conference

• Print Draft Cheque

• Pre-Registration

• Request Status and Account Information

• Get Information About Products, Services, & Offers

• Authenticate Documents

Features

• Customized design and branding• International standards

• Multiple languages

• Multiple currencies

• Multiple payment channels (cash, card, voucher)

• Online monitoring & control

• Reporting system

• Advertisement Module

• Wire Transfers